how to check income tax

You the buyer are treated as paying the taxes beginning with the date of sale. See if your tax code has changed.

Does A Change In Income Impact Your California Inflation Relief Check

Check your tax code and Personal Allowance.

. A physical check will be mailed to the. If you are unsure if you can claim the EITC use the EITC Qualification Assistant. Income Tax exemption for Covid-19 treatment.

Double-check your tax return before you mail it or submit it through an online e-filing service. Check whether you need to report and pay any tax on income you make apart from your main job or earnings. Shares mutual funds debentures and bonds related cash transactions.

The Non-Business Energy Property Tax Credits outlined below apply retroactively through 12312022. However staff members do look at some returns manually to see whether the taxpayer filed income deductions and credits correctly. Visit the official website at httpswwwincometaxindiaefilinggovin.

You must check the box on Schedule A Form 1040 line 5a if you elect this option. The final package is Premium and that costs 7995 annually. The site directs you to destroy the expired check but you should make a copy of the front and back of the check in.

You qualify for the Earned Income Tax Credit EITC You may not have filed a tax return because your wages were below the filing requirement. Once your Income Tax has been calculated you can use this service to check how much you paid from 6 April 2021 to 5 April 2022. When you submit your first Self Assessment tax return we will check if your qualifying income is more than 10000.

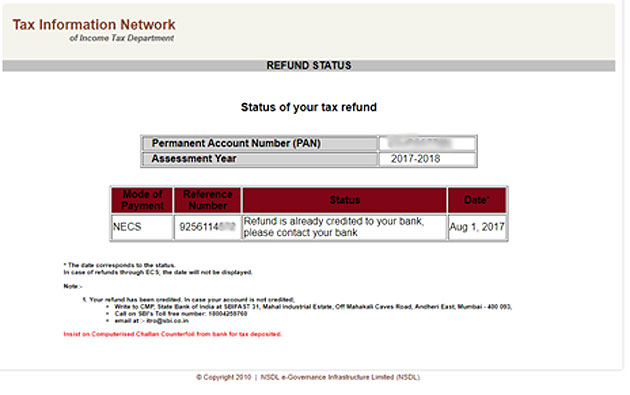

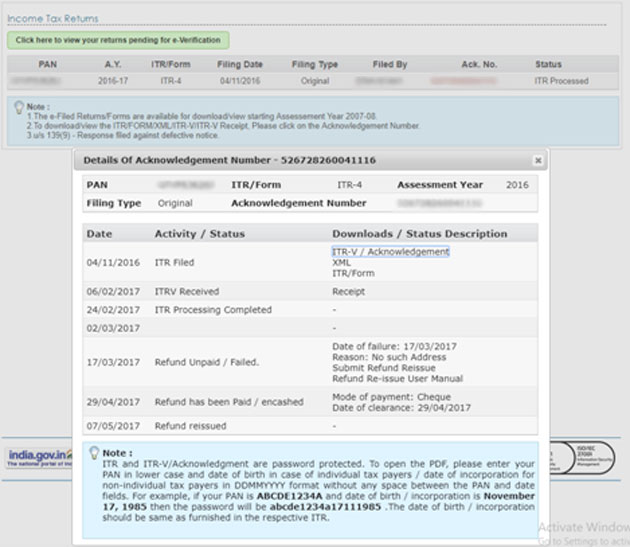

Processing of paper tax returns typically takes a minimum of 12 weeks. You can check your Income Tax refund status via the Income Tax e-filing portal by following the steps given below. The income tax rebate is for Illinois residents who filed individually in 2021 and earned under 200000 -- or filed jointly and made under 400000.

Individual income tax is graduated. By law businesses and individuals must file an income tax. Follow the given steps to get refund status via E-Filing Website.

If you have any other income like student loan interest or dependents youll have to use one of their paid software options. The Central Board of Direct Taxes CBDT recently notified new conditions and a form for claiming exemption against expenses on Covid-19 treatment. To check the status of the refund there is no separate tab for it in the new portal just click on the service tab and then click on the refund reissue tab.

In some cases they will send a filer a letter asking for more information. Enter the PAN Acknowledgement Number and Captcha Code. Click on Submit to check the status of your refund.

10 of cost up to 500 or a specific amount from 50-300. Use the EITC tables to look up maximum credit amounts by tax year. For federal income tax purposes the seller is treated as paying the property taxes up to but not including the date of sale.

Income tax rates for 2021 range from 1 to 65 on Idaho taxable income. To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit limits for the current previous and upcoming tax years. This service covers the current tax year 6 April 2022 to 5 April 2023.

We process most returns through our automated system. If you end up with an expired IRS refund check youll need to apply for a replacement with the IRS. Tax Act Tax Act has free online filing for both state and federal taxes.

Information about Form 990-EZ Short Form Return of Organization Exempt from Income Tax including recent updates related forms and instructions on how to file. You can also login. Log into the Income Tax e-filing portal.

But you can still file a return within three years of the filing deadline to get your refund. Under the e-File menu select Income Tax Returns and click on View Filed Returns Step 3. If you had a new baby or adopted a new baby in 2021 you have a qualifying child.

Because monthly Child Tax Credit payments were not made for qualifying children not listed on your most recent income tax return a qualifying child added in 2021 generally entitles you to receive the full 2021 Child Tax Credit as a lump sum. 30 March 2017 Added a link to the off. With Income Tax login.

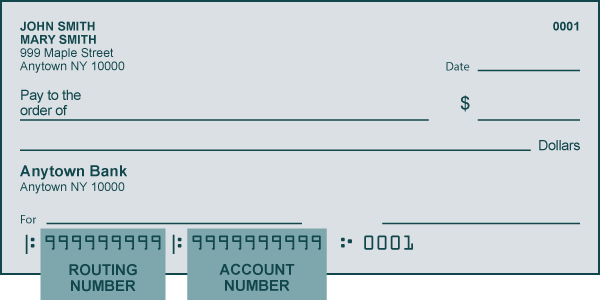

HM Revenue and Customs HMRC calculates everyones Income Tax. How to Check Income Tax Refund Status through E-Filing Website. To determine the status of your return you can use the IRS tax refund tracker which will also let you know if your return has been rejected by the IRS because of errors.

For those who have filed state income taxes and claimed a property tax credit for 2021 and are not claimed as a dependent on another return nothing additional is needed to receive the property. An income tax is a tax that governments impose on financial income generated by all entities within their jurisdiction. The check employment status for tax tool has been updated so if you do not know the worker the tool will not ask questions about their circumstances.

This means that Idaho taxes higher earnings at a higher rate. The Basic package costs 3995 and the next tier is Deluxe at 5495. Last week the Central Board of Direct Taxes CBDT declared that the department had issued refunds of over Rs 114 lakh crore to more than 197 million taxpayers between April 1 and August 31.

You can check income tax refund status in the following manner. For information about your state tax refund check contact your state revenue department. The Income Tax Department may examine whether the buyer has reported the income in hisher tax return.

You will see a list of your previously submitted ITRs. Updates will be applied for 2023 and remain effective through 12312032. Certain organizations file Form 990-EZ to provide the IRS with the information required by section 6033.

If it is we will tell you when you must start meeting the requirements. The IRS website directs you to call 800-829-0922 or 800-829-3676 to order the forms and publications youll need to request a replacement check. Use the service to.

Deductible sales taxes may include sales taxes. Read on to learn how IRS.

Income Tax Refund Status How To Check Income Tax Refund Status

How To Track Tax Refunds And Irs Stimulus Check Status Money

When To Expect Your 2022 Irs Income Tax Refund

Where Is My Tax Refund How To Check The Status After Filing Your Return Pittsburgh Post Gazette

Tax Documents Needed For Marriage Green Card Application

Want To Track Your 2022 Tax Rebate Check Out This Tool From The Idaho State Tax Commission Idaho Capital Sun

How To Check Status Of Income Tax Refund My Shop

How To Check Your State Tax Refund Status Lovetoknow

Consumers Could See Tax Refunds Stimulus Checks At The Same Time Marketplace

Fact Check 16th Amendment Made Income Tax Permanent

Are You Getting Relief Checks From Illinois Here S How To Check Your Rebate Status Nbc Chicago

How To Check Income Tax Refund Status Deccan Herald

2 Ways You Can Check Income Tax Refund Status In Minutes Business News

How To Check Your Irs Refund Status In 5 Minutes Bench Accounting

Income Tax Refund Status How To Check Income Tax Refund Status

Income Tax Refund Status Online In 2022 Guide How To Check

Do You Need To File A Tax Return In 2022 Forbes Advisor

Tax Day 2022 Deadline To File Is Monday What To Know If You Need An Extension

0 Response to "how to check income tax"

Post a Comment